Bitcoin (BTC) shorts have once again started to pile up as the bulls have lost control once again. This is all for the best as BTCUSDShorts would now be able to test the trend line resistance. If it faces a rejection at that level, we should see a rise in BTC/USD. We expect that to happen this week as BTC/USD has to make one last move to the upside before the correction to the downside can begin. Before this move to the upside, the probability of a fall in BTC/USD remains very low. The daily chart for BTCUSDShorts shows that the bears have overplayed their hand short term and the number of margined shorts will have to come down in the days ahead. That being said, trading conditions for BTC/USD are not favorable either in the long term.

The most probable scenario at this stage is the one that we have been pointing to for the last two weeks and that is a short term rise in BTC/USD followed by the inevitable correction to the downside. This event keeps on being delayed as we have seen most probably because it was too obvious. This is not how markets work. If things are too obvious, attempts are made to make it confusing so that retail traders can be trapped in their positions. The same has happened at last. The number of margined shorts is one the rise which will make the bulls scared and the bears confident. Once the bears start opening short positions, the whales would pump the price and the subsequent rally would be fueled by the carcasses of the bears as their positions are liquidated.

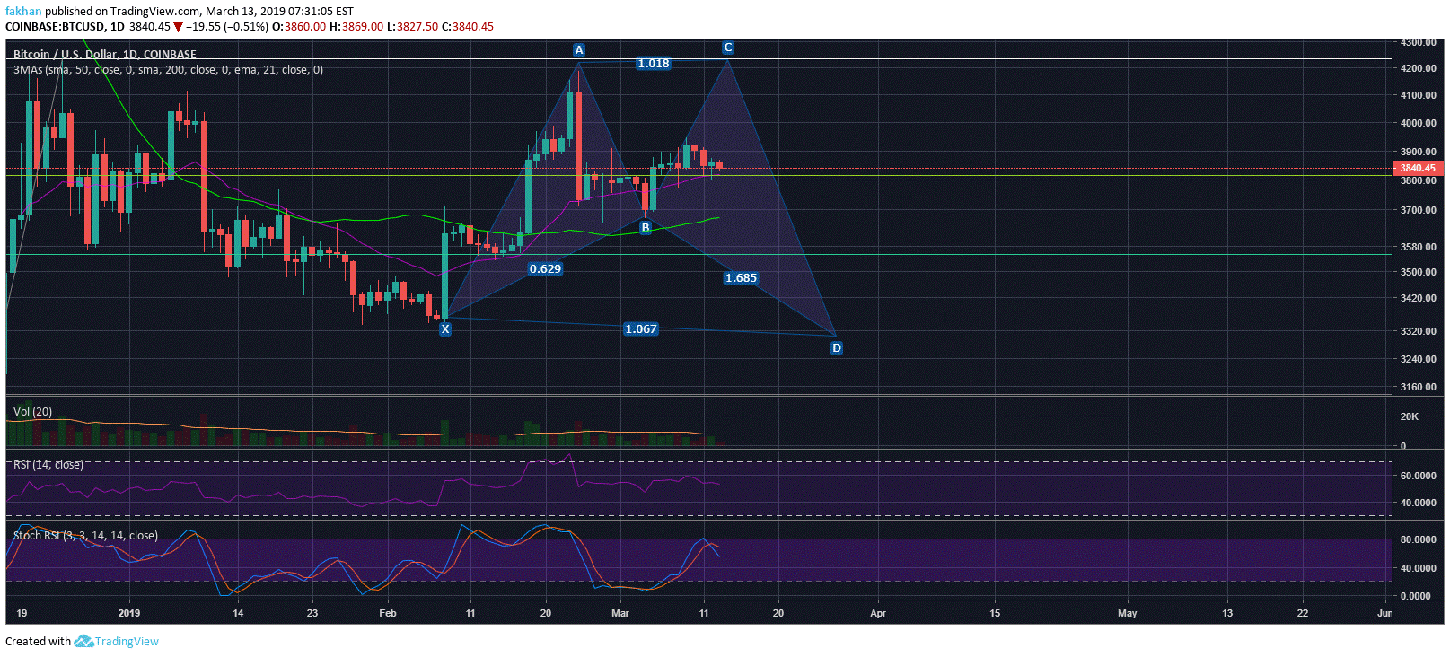

For those that want to see, the signs are still there and BTC/USD is telling us the same thing it has been pointing to for the last two weeks. The price has to complete a bullish gartley pattern whether it is now or two weeks from now. The daily chart for BTC/USD shows the price resting atop the 38.2% Fib extension level. The price is extremely unlikely to fall from here without closing above $4,000 on the weekly time frame. If things remain as they are, we may even see this week go by as inconsequential and then we will have to wait for the spike next week, but the spike has to form before we see a correction to the downside.

Bitcoin (BTC) has seen plenty of bullish developments in the recent past. Even a lot of pulls conducted by some industry leaders in this space as well as the polls by Crypto Daily indicate that investors would rather buy Bitcoin (BTC) now than wait for a bottom and risk losing the chance to buy at such low prices. There are traders in this market who want to get in with the best prices so they can make a certain profit when they sell. However, there is also a large majority of value investors in this market who do not think that way. They see an asset that has declined more than 80% and they think it is a good time to start shopping.

The post Bitcoin (BTC) Shorts Begin To Pile Up As Bulls Give Up Once Again appeared first on cryptodaily.co.uk