Litecoin (LTC) is at a risk of a major decline as the price has run into a strong resistance and faced a rejection. The near term outlook indicates that the price could slide down to the 38.2% Fib extension level in the days ahead. This fall would pull the price close to the 200 day moving average. If the bulls fail to step up, we might see a decline below the 200 day moving average. So far, the probability of such a decline for the rest of the market remains low but Litecoin (LTC) already had a series of rallies and is now overdue for a correction to the downside. The daily trading volume has increased significantly for LTC/USD in the past few weeks and we expect it to continue to increase in the weeks leading to Litecoin (LTC)’s upcoming halvening in August, 2019.

Litecoin (LTC) bulls are very hopeful because halvening has always resulted in a major price boost for any cryptocurrency, be it Litecoin (LTC) or Bitcoin (BTC). This is because nothing moves the price like good old supply and demand. If it takes $X to mine one Litecoin (LTC), after August, 2019 it is going to take more than $2X to mine one Litecoin (LTC). This means that the Litecoin (LTC) supply that is already in circulation will be worth a lot more. There is no doubt whatsoever that the next halvening could see a strong rise in the price of Litecoin (LTC). However, that is in August, 2019 which means it is going to happen in almost four months from now. A lot could happen in four months.

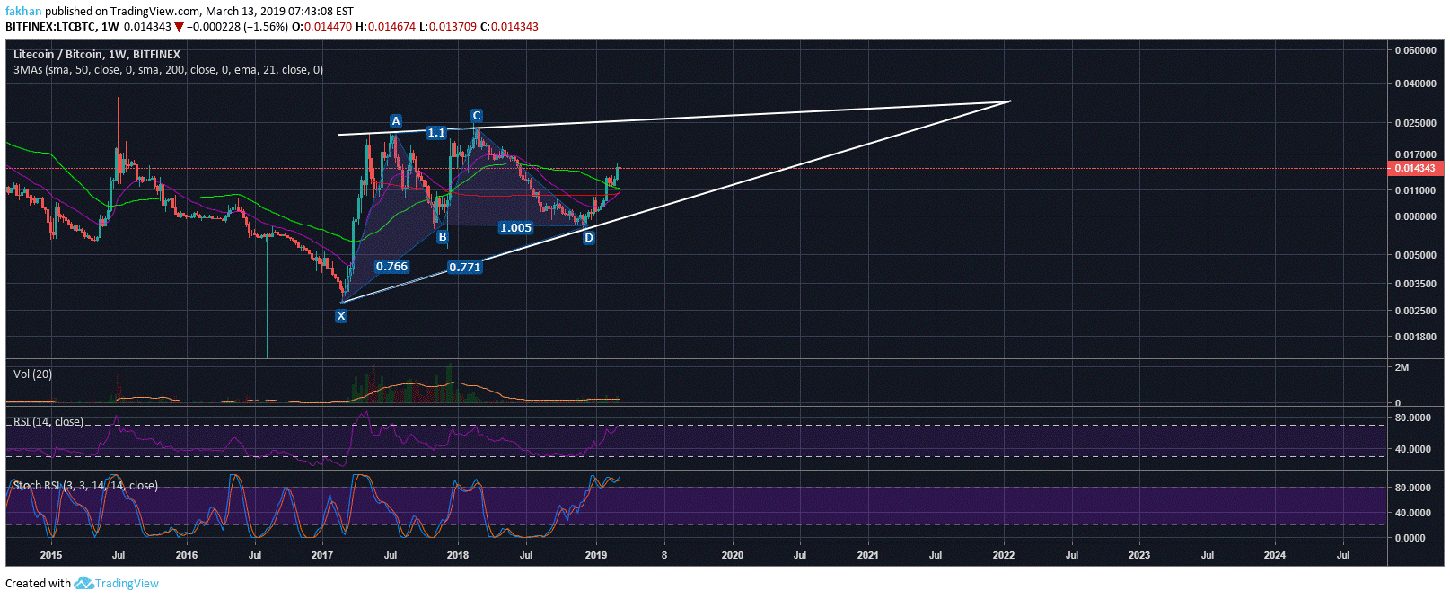

The weekly chart for LTC/BTC shows Litecoin (LTC) trading above the 50 week moving average against Bitcoin (BTC). However, if we start to see a market decline in the next week as expected, we might see LTC/BTC fall below the 200 week moving average and trigger a death cross. This would be an extremely bearish development one that could see Litecoin (LTC) drop significantly against Bitcoin (BTC) as well as the US Dollar. Most retail traders may not realize this but the whales profit off such events in multiple ways. For instance, they know just by looking at the charts that the price is due for a correction in the near future. If it doesn’t happen this week, it will happen next week but a strong decline is inevitable.

So, what the whales do is first instill some FOMO in the market way before the event (halvening). So, now that retail traders have FOMO’ed into Litecoin (LTC) because of halvening, they want to profit off the rally and the price is supposed to come down anyway, so they start unloading their bags. The end result of this is that the retail traders leaves dejected and heartbroken and sells their bags to the whales dirt cheap. The whales accumulate in the weeks leading to halvening and dump their bags again when the price rallies after halvening. Now, those that are trading Litecoin (LTC) or Bitcoin (BTC) or any other cryptocurrency, the fundamentals of what they trade may not matter. However, if you plan on investing rather than trading, it would be a good idea to take the long term outlook and use cases of the cryptocurrency into account.

The post Litecoin (LTC) Likely To Slide Below $50 In The Near Future appeared first on cryptodaily.co.uk